The passing score is 75. How is the passing score determined?

The minimum passing score for the CPA Exam is 75. The score is not a percentage (or the percentage of correctly answered questions). Several factors are taking into account for the CPA Exam scoring. These factors include:

- The level of difficulty of each question and testlet.

- Multi-stage testing and scoring.

The key to success:

- How much do you really want to pass, and

- Practice, Practice, Practice

Level of Difficulty of Questions and Testlets

The CPA Exam scoring system ranks each question and assign a value (weigh) based on its level of difficulty. The questions do not have the same value. The difficulty of each question is determined by statistical analysis of the responses of candidates. When questions are used as pre-tests, statistical data is collected. The data is then used to score the CPA Exam when questions are actually operational.

At the question level, difficulty is not quantified as a category (e.g., moderate or difficult), but as a numeric value along a scale. Therefore, all else being equal, a candidate who correctly answers 10 difficult questions would score more than a candidate who correctly answers 10 easy questions.

Consequently, testlets are classified as either medium or difficult based on the average difficulty of the questions within that testlet.

Weighted Combination of Scaled Scores

| Item Type | AUD, FAR, REG, BAR, TCP | ISC |

|---|---|---|

| Multiple Choice Questions (MCQs) | 50% | 60% |

| Task-Based Simulations (TBSs) | 50% | 40% |

Linear Testing and Scoring

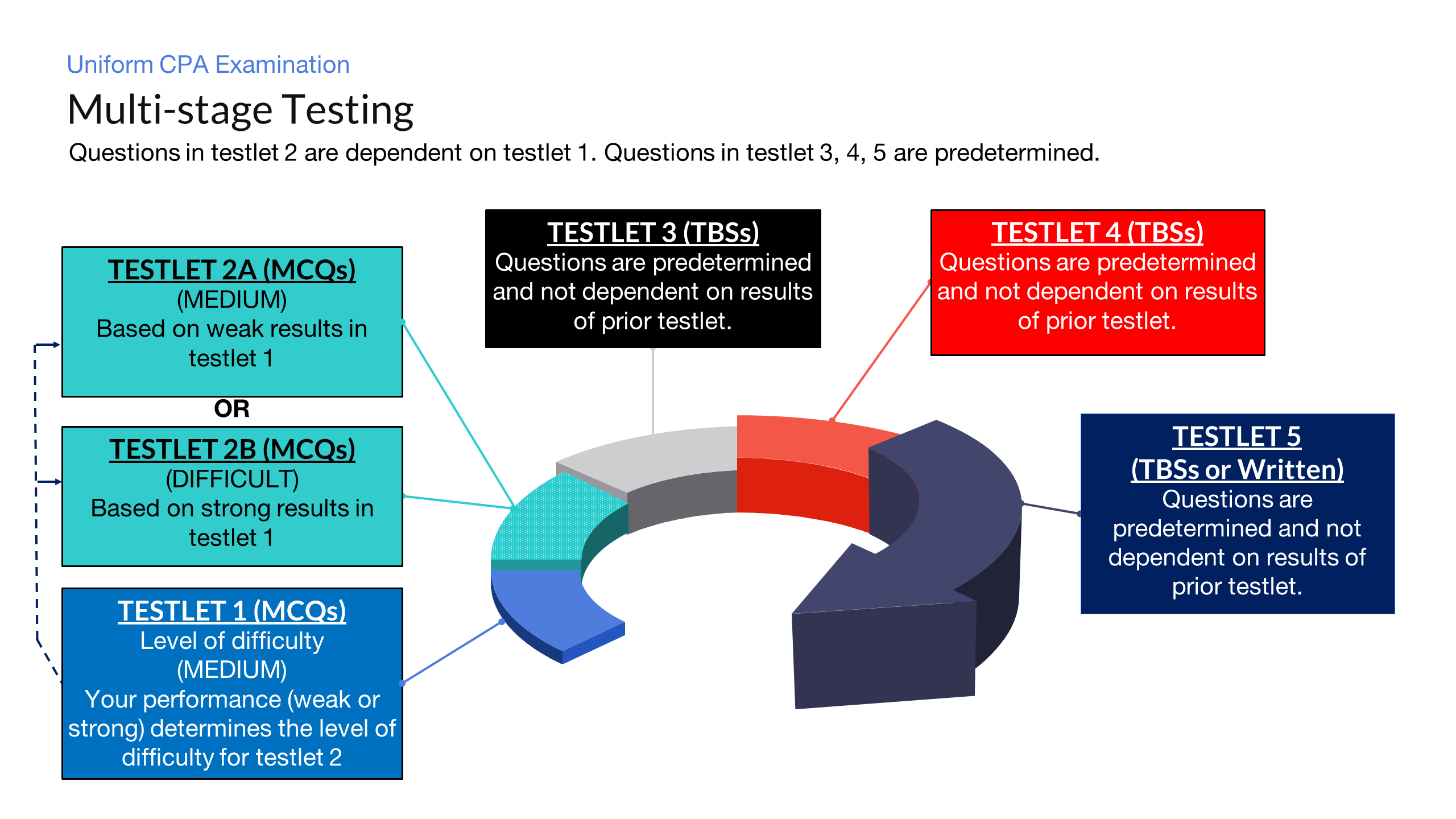

Five stages (teslets) are included in the CPA Exam. Each testlet must be completed and submitted before moving on to the next.

Testlets 1 and 2

Testlets 1 and 2 contain multiple choice questions of varying difficulty. You will take different, but equivalent exams. The questions presented to you are drawn from a pool of test questions according to defined specifications. Although you take different exams, the specifications ensure that the results are comparable. The scores are scaled using predetermined factors because of the performance and difficulty levels.

Multiple choice questions (1st 2 testlets) accounts for 50% of your overall score for the following parts of the CPA Exam (AUD, FAR, REG, BAR and TCP) and 40% for the ISC exam.

Testlets 3 to 5

The questions for Testlets 3 to 5 are pre-determined and contains task-based simulations (TBS). Therefore, these testlets are not based on the performance of a previous testlet. For AUD, FAR, REG, BAR and TCP, task-based simulations (TBS) accounts for 50% of your overall score. For ISC, task-based simulations (TBS) accounts for 40% of your overall score.

Your performance on the MCQ section of the exam will not affect the TBS section of the exam.

Pretest Questions

Testlets are blocks of questions that make up each exam section. The testlets include pretest and operational questions. Pretest questions do not receive a score, but operational questions will. The pretest questions and operational questions look the same. Pretest questions become operation questions on future exams if they satisfy certain criteria. It is common to use pretesting in tests with high stakes. Pretest questions do not have scores, so the right or incorrect answers won’t affect your final score.

Please select the following link to access this detail information on the AICPA website. Click for more on CPA exam scoring.

Contact CPA EXAM COACH to learn more about our solutions for passing the CPA Exam. Register with CPA EXAM COACH and lets work together to get you passed.

You may also email us at info@cpaexamcoach.com to have your questions and concerns about the CPA Exam answered.