Be familiar with the CPA Exam Structure

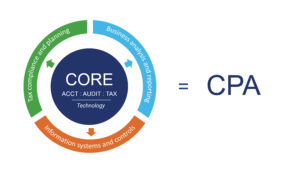

The CPA Exam is a computer-based test comprising of two modules called core and discipline. The core module contains three compulsory parts (courses), namely: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Regulation (REG). The disciple module contains three optional parts (courses), namely: Business Analysis and Reporting (BAR), Information Systems and Control (ISC) and Tax Compliance and Planning (TCP). Students will choose one of the options. To complete the CPA Exam, a student will do 3 Core Courses + 1 Discipline Course = 4 Courses in total.

The CPA Exam is a computer-based test comprising of two modules called core and discipline. The core module contains three compulsory parts (courses), namely: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Regulation (REG). The disciple module contains three optional parts (courses), namely: Business Analysis and Reporting (BAR), Information Systems and Control (ISC) and Tax Compliance and Planning (TCP). Students will choose one of the options. To complete the CPA Exam, a student will do 3 Core Courses + 1 Discipline Course = 4 Courses in total.

For all courses, each exam is structured in five parts, called testlets. All exams contain multiple choice questions (MCQ) and task-based simulations (TBS). The BEC exam has a written component. The courses’ exam may be taken separately, in any order, and in any combination. The AICPA allows this flexibility. A student is allowed 30 months from the date you pass the first course, to pass all remaining parts (courses).

Exam Structure Summarized

| MODULES | CORE |

DISCIPLINE |

||||

|---|---|---|---|---|---|---|

| SECTIONS | AUD | FAR | REG | BAR | ISC | TCP |

| Hours | 4 | 4 | 4 | 4 | 4 | 4 |

| Testlet-1 (MCQ) | 39 | 25 | 36 | 25 | 41 | 34 |

| Testlet-2 (MCQ) | 39 | 25 | 36 | 25 | 41 | 34 |

| Testlet-3 (TBS) | 2 | 2 | 2 | 2 | 2 | 2 |

| Testlet-4 (TBS) | 2 | 2 | 3 | 2 | 2 | 2 |

| Testlet-5 (TBS) | 3 | 3 | 3 | 3 | 2 | 3 |

| Score Weight (MCQ) | 50% | 50% | 50% | 50% | 60% | 50% |

| Score Weight (TBS) | 50% | 50% | 50% | 50% | 40% | 50% |

| Skills Level Assessed | ||||||

| Remembering and Understanding | 30-40% | 5-15% | 25-35% | 10-20% | 55-65% | 5-15% |

| Application | 30-40% | 45-55% | 35-45% | 45-55% | 20-30% | 55-65% |

| Analysis | 15-25% | 35-45% | 25-35% | 30-40% | 10-20% | 25-35% |

| Evaluation | 5-15% | – | – | – | – | – |

The first two testlets contain multiple choice questions. Generally, these are short version questions with four possible answers and comprise approximately 50% of the exam.

Task-based simulations are case studies that allow candidates to demonstrate their knowledge and skills by generating responses to questions rather than simply selecting an answer. They typically require candidates to use spreadsheets and be able to apply, analyze and evaluate content and knowledge to produce a correct answer.

Skills Assessment Summary

| Skills Level | |

|---|---|

| Evaluation | The examination or assessment of problems, and use of judgment to draw conclusions. |

| Analysis | The examination and study of the interrelationships of separate areas in order to identify causes and find evidence to support inferences. |

| Application | The use or demonstration of knowledge, concepts or techniques. |

| Remembering and Understanding | The perception and comprehension of the significance of an area utilizing knowledge gained. |

More information including questions and answers about the exam structure can be access from the AICPA website at www.aicpa.org.

Contact CPA EXAM COACH to learn more about our solutions for passing the CPA Exam. Register with CPA EXAM COACH and lets work together to get you passed.

You may also email us at info@cpaexamcoach.com to have your questions and concerns about the CPA Exam answered.

The keys to success: 1. How much you really want to pass and 2. Practice, Practice, Practice