Our CPA Exam Coach Methodology

What are the facts?

At CPA Exam Coach, we realize students have different knowledge levels, learning styles, motivation levels and personal circumstances, which impact their CPA Exam outcomes. The “one size fits all” model does not always work. Consequently, we have invested in leading adaptive learning applications which provide a customized and efficient learning path for our candidates.

Even with great technology, there is still the need for human intervention and direction to complement and supplement, in order to ensure positive outcomes. And that’s why our teaching style and learning products are built around the following themes:

- Separate your strong areas from your weak areas

- Focus on weak areas (allocate more time to weak areas and less to strong areas)

- Teach concepts from the bottom up

- Practice learning and learn practicing

- No one should be left behind

We believe that with the right tools and coaching all candidates will pass the CPA Exam.

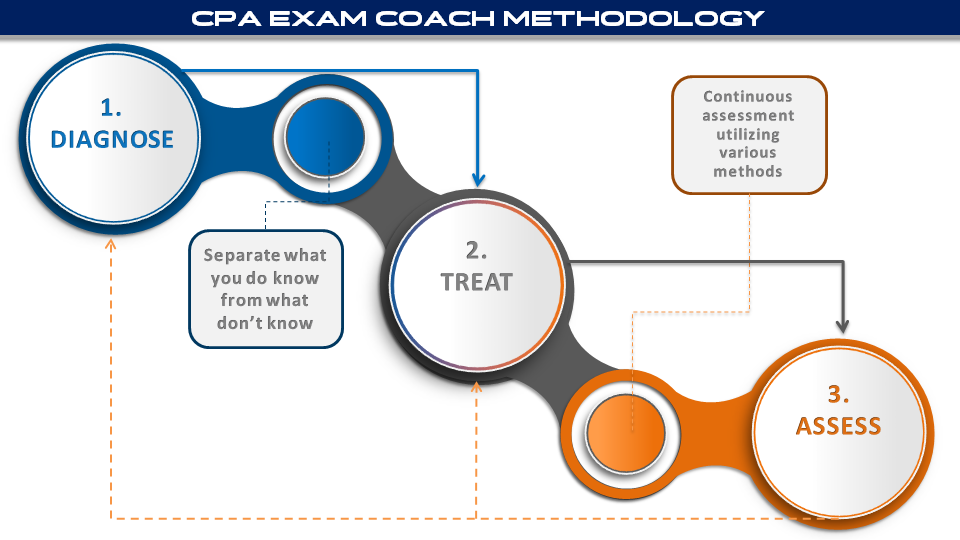

Our coaching and learning products incorporate three key elements: Diagnose, Treat and Assess.

Diagnose: The CPA Exam calls on a candidate’s education (120 – 150 credit hours + more) and experience. Even though we all come to the table with these achievements, the reality is candidates come to the CPA Exam table at different levels of knowledge, motivation and exposure. As a practical example, we teach students who practice auditing as a profession and so bring to the table both theory and practice. We also teach students who have never worked in the auditing profession, or they worked as internal auditors, federal auditors, tax auditors or financial statement auditors. Therefore: 1. Should the approach be the same? 2. Should all students go through the same loops?

This is why at CPA Exam Coach, we do a comprehensive diagnostic aim at identifying what a student knows from what a student does not know. The focus then becomes employing learning and retention tools and techniques to address what the student does not know.

Treat: The objective is to turn weak areas into strengths and maintain old and existing strengths. Therefore, our treatments include:

- A balance diet: Class time and personal study time will be aligned with outcomes of the diagnostics. More time will be allocated to weak areas than strong areas.

- Exercise: The best learning and retention methods are participatory, not watching videos (however, these do have their purpose). We “learn by doing”, that is, at CPA Exam Coach students “practice learning and learn practicing.”

- Therapy: We teach concepts in a manner which assumes very little prior knowledge and experience and we support our students 24/7/365. Why is this necessary? As a practical example, we recall a student who had just the minimum accounting credits required to become a candidate for the CPA Exam (had a BSc in International Relations). The student easily passed all parts of the CPA Exam except Financial Accounting and Reporting (FAR) and struggled on FAR because most of the FAR CPA Exam content areas were new to the candidate and the required 24-30 accounting credits required to apply as a candidate meant low appreciation of some accounting concepts. This candidate is similar to several candidates; therefore, we teach concepts from the bottom up and offer face-to-face classes as well as recorded audio and video lectures.

Assess: Our classes and learning products are built around continuous and comprehensive assessments through quizzes, tests, mock exams, in class participation and online assessments. Each assessment is diagnosed to determine whether students have improved and what are the recurring weak, improved and strong areas. We employ new and different methods to treat recurring weak areas. The diagnose, treat and assess process is a recurring loop that continues until the candidate is prepared to take the exam.

Contact CPA EXAM COACH to learn more about our solutions for passing the CPA Exam. Register with CPA EXAM COACH and lets work together to get you passed.

You may also email us at info@cpaexamcoach.com to have your questions and concerns about the CPA Exam answered.