The CPA Exam Evolution – A Great Change!!

Change is Inevitable

If you have been around as long as I have been, you are probably able to carefully plot the CPA Exam evolution and changes to the accounting profession. From the non-technology (paper-centric) environment to the technology-dependent and evolving environment we are in today. At 18 years old, I was offered a job at PwC. At that time, audits and accounting were paper-based and we did paper-based exams. We carried those big Attaches (Briefcases) full of papers :-D.

I have seen audit and accounting evolve from the dark to the light ages. From paper-based ledgers to AS400 and dumb terminals. Then to PCs and database driven AIS and over time evolving to cloud-based tap-into anywhere applications. Today, we carry laptops, tablets etc., and we are able work from anywhere. Changes and more changes; however, don’t be fearful. I am still practicing audit and accounting and, in my opinion, I am still creme de la creme prime ribs.

So, where I am going with all that?

Approximately, twenty years ago, in 2004, the CPA Exam Evolution had a “seismic” change, from a paper-based to a computer-based exam. Switching from the paper-and-pencil exam to the computer-based exam marked one of the most significant changes in the over 100-year history of the CPA Examination. Among other things, psychometric was introduced and the then four (4) core courses were reorganized into a new four (4) core courses. And so BEC was transplanted/engrafted. Students then were anxious and worried about the impact of the change. This was especially true for those students who had to transition credits already passed, and for whom the CPA Exam was a work-in-progress at the date of transition.

The Risk Then

The biggest risk then was not transitioning the credits. It was losing credits already passed. Consequently, candidates had to study slightly new, and in some instances significantly new, content.

Twenty Years Later

So, 20 years later, in 2024, the CPA Exam will make another “seismic” change, which is dubbed THE CPA EVOLUTION!!.

The Risk Now

So, what are the risks (from the lenses of taking the exam), if any, of the pending 2024 CPA Exam change?

- Current CPAs – none, you have already passed the CPA exam and won’t be required to retake any exams. You have been doing your CPEs, right?

- Those who will attempt the exam for the first time in 2024 – you probably won’t care about the past exam, and why would you? It’s not a change for you – its new to you. Get the new content specification in 2023 and use that. Colleges and Universities should be changing their curriculum to better prepare you for the exam.

- Those currently doing the exam and/or will transition – now here’s the risk. Therefore, my advice to this group is to hunker-down and make all efforts to complete the exam by December 31, 2023.

The CPA Exam Evolution (CPA Evolution Model)

Objective of the CPA Exam Evolution – It aims to transform the CPA licensure model. It recognizes the rapidly changing skills and competencies the practice of accounting requires today and will require in the future. Becoming a CPA means you’ll need greater skill sets and competencies, and a greater knowledge of emerging technologies.

Main Organizations behind CPA Exam Evolution – The National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA). They (and the community of inputs) believe this approach is responsive to stakeholder input and propels the profession into the future.

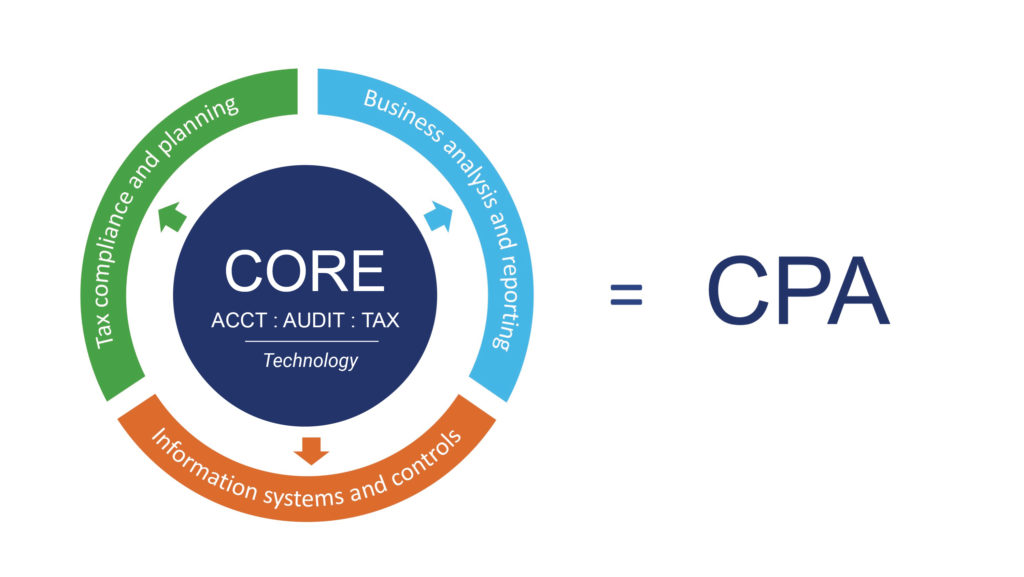

The New CPA Exam Evolution Model – The new model is a core + disciplines licensure model. The model starts with a deep and strong core in accounting, auditing, tax and technology that all candidates are required to complete. Each candidate will also choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of chosen discipline, the model leads to full CPA licensure.

The CPA Exam Evolution Transition Policy and Formats

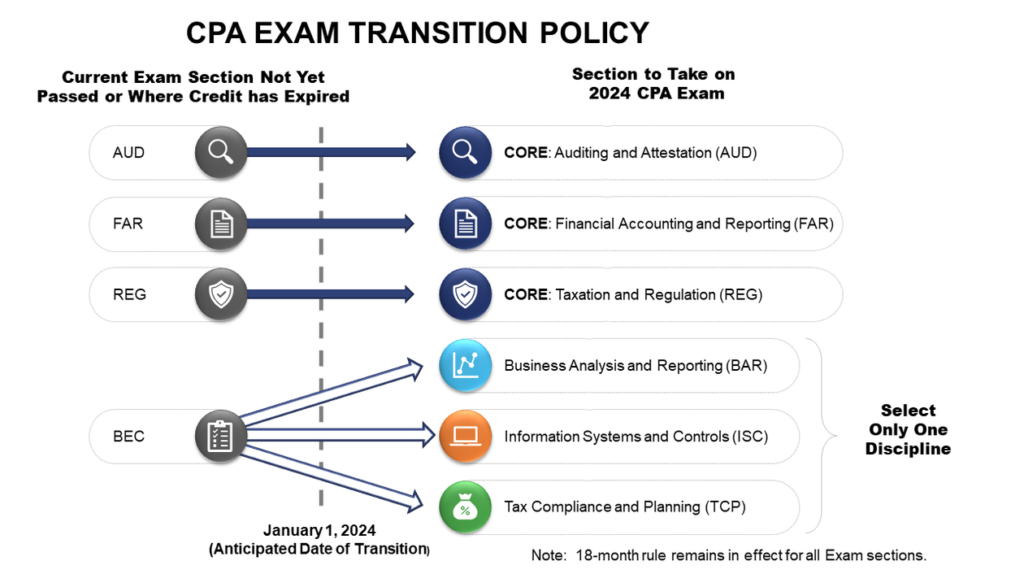

In February 2022, NASBA announced the transition policy for candidates who have started, but not completed, the CPA Exam process by January 2024. The following diagram outlines the CPA Exam course transition model.

Transition Impact of the CPA Exam Evolution

Current Courses Not Passed by December 31, 2023

- A candidate who has not passed either AUD, FAR or REG from the current exam by December 31, 2023, must take the corresponding new core section of AUD, FAR or REG effective January 2024.

- A candidate who has not passed BEC from the current CPA Exam by December 31, 2023, must select and take one of the three discipline sections, as shown above.

Courses Passed by, and Lost After, December 31, 2023

- A candidate who loses credit for AUD, FAR or REG after December 31, 2023, must take the corresponding new core section of AUD, FAR or REG in 2014 and beyond.

- A candidate who loses credit for BEC after December 31, 2023, must select and take one of the three Discipline sections to be tested.

Closing

The current CPA Exam format will not be available effective January 2024. Therefore, it is wise to hunker-down for the next year and pass all parts of the current CPA Exam. In 2004, the general view from the change then was that the CPA Exam would be easier to pass, and may be so. However, take a look at the pass rates over the years. So, if the new view from the change is an easier to pass exam, I would not wait.

Important Dates to Watch for CPA Evolution

- July 2022 – Publish Practice Analysis Exposure Draft

- January 2023 – Announce new CPA Exam details and publish new CPA Exam Blueprints

- January 2024 – Launch new CPA Exam

We are available to discuss the 2024 CPA Exam format and how it will impact you. Contact us at info@cpaexamcoach.com or call us at 703-828-2336.

Author: Marshall A. Blair, CPA CIA, CGMA

The author coaches CPA Exam candidates in a classroom setting as well as on a one-on-one basis. He has also completed the Association of Certified Chartered Accountants (ACCA) exam and the Certified Information Systems Auditor (CISA) exams.

See other articles: Considering the Core Plus Model

Credits: NASBA, Journal of Accountancy, AICPA, This Way to CPA